- Kiyosaki Uncensored

- Posts

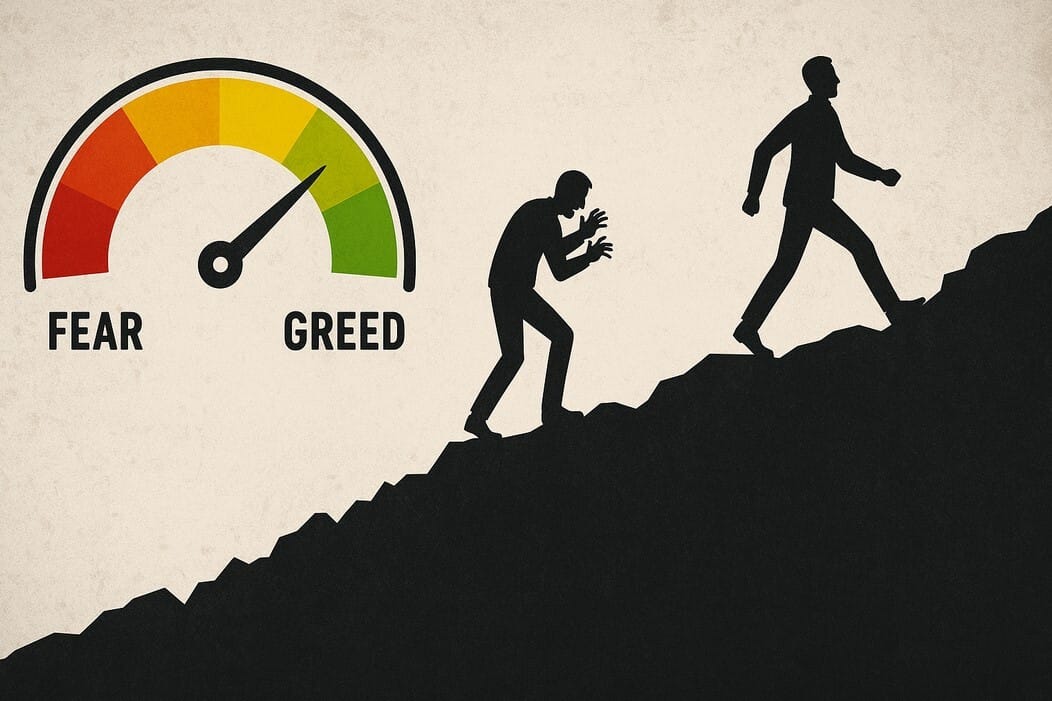

- From Extreme Fear to Extreme Greed

From Extreme Fear to Extreme Greed

Trump racks up another win…

From Extreme Fear to Extreme Greed in three short months…

TRUMP’S CURSE: A $35 Trillion Meltdown Ahead? Robert Kiyosaki just issued his boldest warning yet — and he says the clock’s almost out of time.

Dear Reader,

The president announced a trade accord with Japan yesterday.

In his telling, the terms favor the United States — substantially:

We just completed a massive Deal with Japan, perhaps the largest Deal ever made. Japan will invest, at my direction, $550 Billion Dollars into the United States, which will receive 90% of the Profits. This Deal will create Hundreds of Thousands of Jobs — There has never been anything like it.

Perhaps most importantly, Japan will open their Country to Trade including Cars and Trucks, Rice and certain other Agricultural Products, and other things. Japan will pay Reciprocal Tariffs to the United States of 15%...

I am far from convinced Japan will invest $550 billion into the United States. Yet I let it pass.

“Japan Is Desperate”

Why did Japan settle largely on American terms?

The Kobeissi Letter:

In order to agree to this "deal," Japan's economy must be far worse than most people expect… Japan is desperate.

As Japan faces an economic crisis, treasury yields just keep on rising.

Japan's 30Y government bonds have LOST -45% of their value since 2019.

This deal is a last ditch effort to save their economy.

Need you further evidence that Japan’s three-decade “stimulus” delirium has merely stimulated debt?

🚨 The Utility Wealth Transfer Has Begun… Are You In?

America’s power grid is undergoing a $2.5 trillion overhaul, and Robert Kiyosaki just released the one guide that shows how to profit from it like an insider.

If you want a slice of this transformation before Wall Street seals it off…

👉 Click to claim your free Power Grid Profiteers Guide.

You’ll also receive Kiyosaki’s bold new eletter Money, Power and Profit with strategies you

Stocks Surge to Record Heights

Meantime, stocks were up and away on yesterday’s announcement.

Whispers that the United States was nearing a similar accord with the European Union further set the animal spirits rampaging.

The Dow Jones Industrial Average ended trading 507 points to the good yesterday — a mere four points short of record heights.

The S&P went vaulting 49 points, the Nasdaq Composite, 127 points.

Both indexes did in fact attain record heights yesterday.

Thus the bulls run amok… and the bears scatter in headlong retreat.

CNN’s “Fear and Greed” index presently registers “Extreme Greed.”

In April the identical index registered "Extreme Fear.”

And so investors catapult from one extreme to the other… in a mere three months.

Risk On!

Reports the above-referenced Kobreissi Letter:

Risk appetite is through the roof:

Call options now reflect ~68% of all options market volume, the highest since 2021, according to Goldman Sachs. This is only below the meme stock frenzy peak of ~72% in 2020-2021. By comparison, this percentage hit ~42% at the lowest point during the 2022 bear market…

Speculation is back in full force.

Yet is speculation back in full force among all investors?

What are the institutional investors — the “smart money” — up to?

Institutional Investors sold -$800 million in single stocks and ETFs last week, building on -$2.4 billion in the previous week.

This marks their 10th week of selling out of the last 11. Over the last 4 weeks, institutional investors have sold -$8.5 billion in equities in total. On the other hand… retail and hedge funds purchased +$1.2 billion and +$400 million, respectively. Retail investors have now been net buyers for 30 out of the last 32 weeks.

Wall Street vs Main Street continues.

My wager is on Wall Street.

Too Many Eggs in One Lone Basket

I notice that Bank of America’s Michael Hartnett is preparing to work the “sell” switch.

That is because essentially all the dials on his market indicator are reading sell.

Far too many eggs nestle in one lone basket — the technology basket.

A mere handful of technology stocks are hauling the market along. The vast majority of stocks are laggards and coattail-riders.

Five technology stocks — led by NVIDIA — presently bulk to a record 27% of the S&P 500’s entire market cap.

Those same technology stocks constitute some 51% of the Nasdaq 100’s market value.

These stocks manifest obscene price/earnings ratios exceeding even those of the dot com mania.

I cited NVIDIA. The behemoth is presently valued higher than the United Kingdom’s entire stock market.

Handsome!

Whack

Thus the market — I believe — is fantastically “out of whack.”

And as newsletter man Bill Bonner is fond to say:

“Things that are out-of-whack tend to go back into whack.”

When will the stock market go back into whack? I do not know.

How will the stock market go back into whack? Again, I do not know.

Yet I believe in the normalizing power of whack. Whack will prevail ultimately — or some semblance of whack at least.

I offer no investing advice… for which my readers are grateful… or should be grateful.

Should I counsel you to purchase an umbrella, you can be certain the sun will shine in perpetuity.

“If You’re not a Contrarian, You’re a Victim”

I observe merely that it is often wise to avoid locations where the crowd is thick.

And though difficult, it is often profitable to graze against the grain of consensus.

The crowd in the stock market is exceedingly thick at present. And the grain of consensus slants in one extreme direction.

And as Mr. Rick Rule of Sprott Natural Resources advises:

“If you’re not a contrarian, you’re a victim.”

Which will you be?

Brian Maher

for Freedom Financial News

P.S. Want a “contrarian” play?

“Rich Dad” Robert Kiyosaki says most people don’t know that America’s power grid is undergoing a $2.5 trillion overhaul.

And Robert just released an exclusive guide that shows how to profit from that overhaul like an insider.

Interested? Want in?